European wind will need to move faster to meet ambitious European targets: WindEurope

WindEurope published his latest report ‘Wind energy in Europe: 2022 Statistics and the outlook for 2023-2027’, where they show that European growth it’s much less than what’s needed for the EU’s 2030 goals. And investments in new wind farms and new wind turbine orders were down in 2022: due to “unhelpful” Government interventions in electricity markets and inflation. The EU and national Governments must restore investor confidence. And they must engage proactively to support the European wind supply chain and enable it to grow. These are some of the main data extracted from the report.

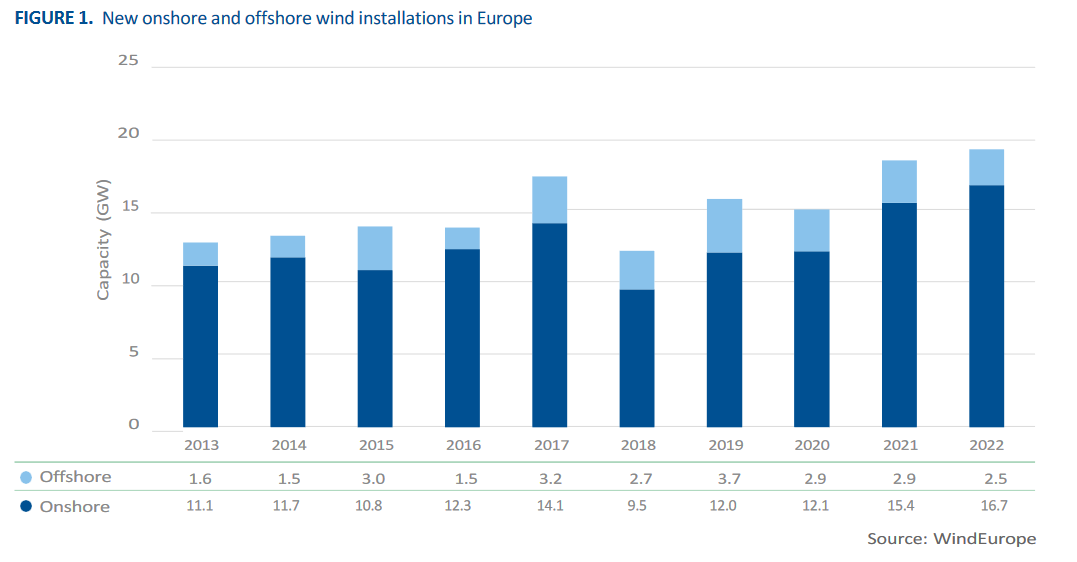

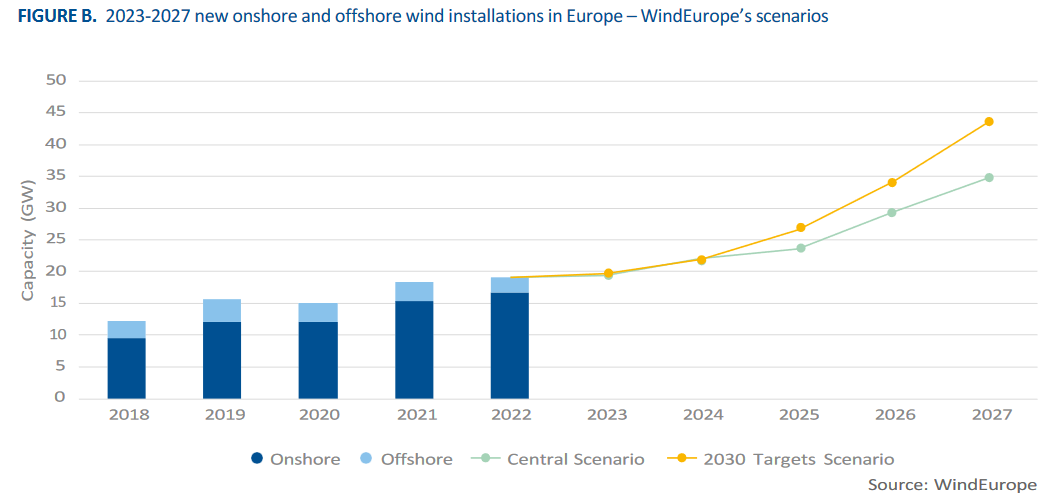

As Christoph Zipf, Press and Communications manager at WindEurope, told Review Energy in an exclusive interview, the EU-27 built 16 GW of new wind. That’s 40% more than in 2021. Over 2023-27 it now expect the EU to build 20 GW of new wind every year on average. “But that is not enough to reach the EU’s energy and climate targets”. The EU needs to build on average 31 GW every year up to 2030. That’s achievable if Europe: (a) continues to simplify permitting rules and procedures; (b) restores clear signals to investors; and (c) invests substantially in the wind energy value chain- factories, grids, ports, vessels, and skilled workers.

Europe is finally making progress on the simplification of permitting rules and procedures. The EU’s new energy strategy, REPowerEU, has helped a lot. Last year’s emergency measures on permitting enshrined for the first time that the expansion of renewables is in the “overriding public interest”. In Germany overriding public interest is already unlocking wind energy projects that had been stuck in court cases.

The ongoing revision of the Renewable Energy Directive is key. The trilogues must really nail the improvements on the table: enshrine overriding public interest in the Directive; the clearer definition of the 2-year permitting deadline; the population-based approach to species protection; and the new rules on repowering.

“Governments are beginning to simplify their permitting rules and procedures for new renewables. Germany is leading the way. They’ve doubled their rate of new onshore wind permits compared to three years ago. Their average permitting time has dropped to two years. Others must follow suit. Permitting is still the number one bottleneck for the expansion of wind in Europe”, said WindEurope CEO, Giles Dickson.

The share of wind in Europe’s electricity consumption is growing. In the EU27+UK it’s now 17%. The European Commission wants wind to be 43% of EU electricity consumption by 2030. But right now new investments and wind turbine orders are falling. 2022 saw only 13 GW of new wind farm investments announced. Not a single offshore wind farm reached final investment decision. Wind turbine orders fell by 47% on 2021 to 11 GW.

Why wind investments are falling? There are two reasons

First is the high inflation in input prices which is insufficiently reflected in developers’ revenues. Higher commodity and other input costs have added 25-40% to the price of turbines, but wind farm developers are often stuck with a revenue base that is not indexed in line with this. Governments must fully index their auction prices and tariffs.

Second, a series of unhelpful interventions in electricity markets by different national Governments have badly undermined investor confidence. The EU’s upcoming reform of Electricity Market Design must urgently restore this confidence. It must make it clear that emergency measures are temporary and must be aligned between Member States. Contracts-for-Difference will play a key role for new investments. But investors must also be allowed to finance their projects with Power Purchase Agreements (PPAs) and on a purely merchant basis if that’s what works best for them.

Strengthening Europe’s wind supply chain

Europe’s wind energy supply chain continues to struggle with low volumes (due to unsolved permitting bottlenecks) and inflation in input costs. But it badly needs to grow: Europe doesn’t have enough factories to build all the new turbines it wants.

The EU Net-Zero Industry Act should make state aid rules more flexible and facilitate grants and finance for investments in new plant and infrastructure. National investment tax credits have a key role to play. And the European Investment Bank should be allowed to finance individual plant investments.

The idea that Germany and France will benefit much more from this than others is wrong. New investments in offshore foundation manufacturing have just been announced in Spain and the Netherlands. Greece is upgrading a cable plant. And Poland is attracting investments in new turbine factories and port facilities.

Comentarios

Sé el primero en comentar...